An institutional investor engaged Atharra to support the acquisition of a multi-site onshore wind portfolio in Europe. Working within a two-day bid window, we delivered a focused technical and commercial assessment identifying material opportunities across energy yield, asset life and reliability.

Atharra then developed a structured value delivery plan, setting out how these opportunities could be executed post-acquisition. Together, the assessment and roadmap strengthening the investor's bid position, improved valuation confidence, and provided a clear, actionable route for capturing value once operational control was secured.

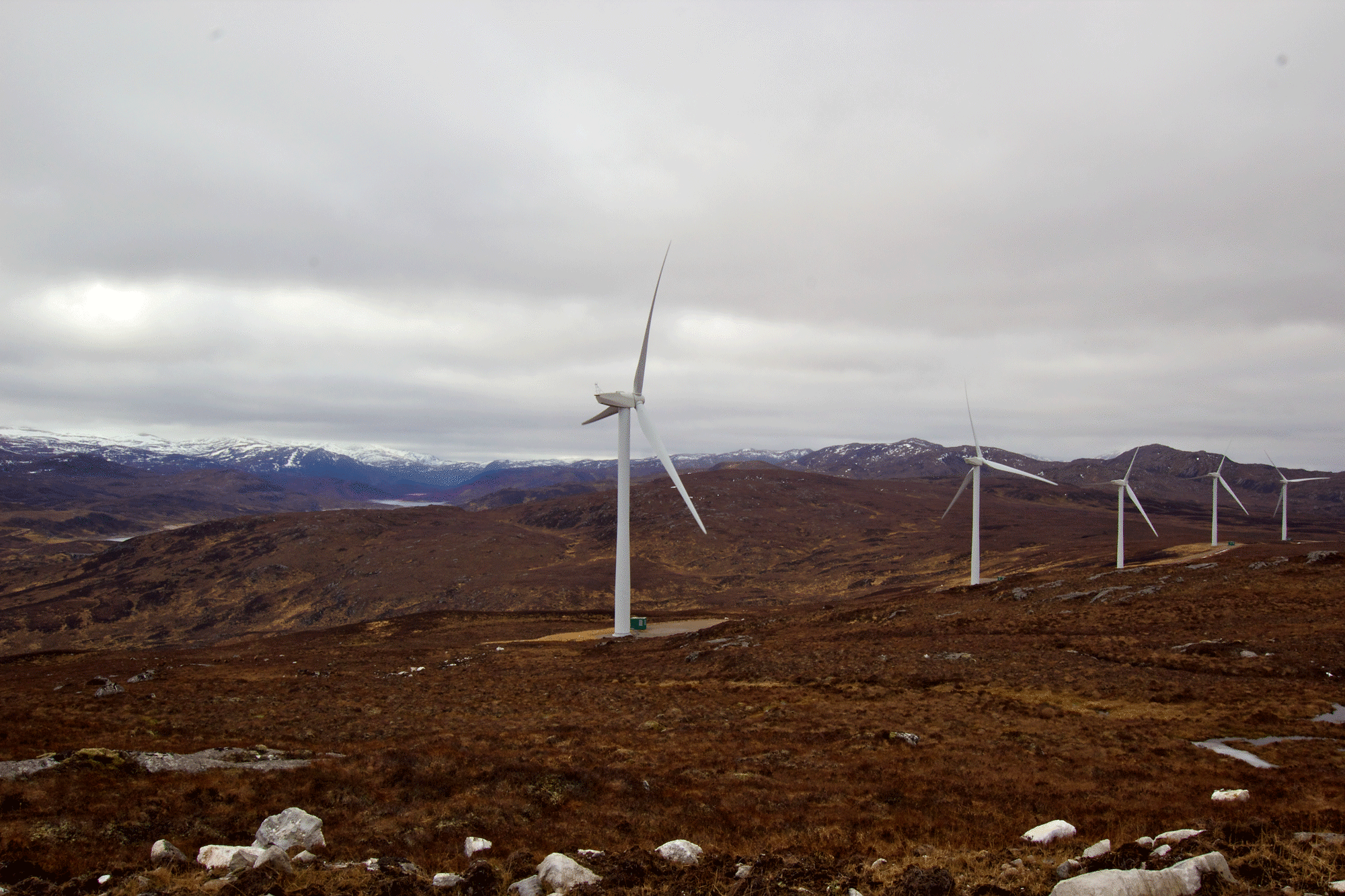

Multi-site, multi-technology wind portfolio

Key initiatives identified, optimising power performance, availability, and asset life

5-year Strategic Value Delivery plan developed targeting €9.5M of additional Net Asset Value

Initiative level CAPEX, timing, AEP impact, and resource requirements provided

From assessment to delivery: a clear route for unlocking performance, life and reliability gains

Atharra brought together practical engineering insight and real operator-side experience to show where meaningful, low-risk value could be unlocked. We set out clear, model-ready assumptions for uplift, cost, and sequencing, supported by realistic risk and feasibility considerations. Building on this, we developed a structured delivery plan covering governance, risk, technical assurance, and the approaches needed to move each opportunity into execution. This gave the investor a credible value case, a defensible valuation, and a straightforward plan for converting identified opportunities into real performance improvements after acquisition.

Get in touch to find out more: hello@atharra.co.uk