The onshore wind industry is evolving, and operators are increasingly being asked to shoulder risks that were once absorbed by original equipment manufacturers (OEM) or covered in full-scope contracts. What’s driving this transition?

- A maturing market: The last major wave of onshore installations took place about a decade ago. With the industry’s focus now offshore, and onshore wind development pipelines constricted, OEMs have less incentive to compete aggressively on long-term, cost-competitive contracts.

- Rising contract costs: Full-scope OEM service agreements are becoming more expensive, particularly on turbine platforms known for serial defects or high-cost component replacements. In some cases where the OEMs past performance has been weak, they may seek to recover those costs through higher pricing in future agreements.

- Aging assets: As turbines near or exceed their design life, failure rates rise and risk profiles change. Many OEMs and ISPs now limit what their contracts cover or withdraw full-scope options altogether.

- A financial opportunity: Some operators see value in managing more risk themselves, especially when they can spread that risk across a large fleet of similar assets. For these players, self-managed O&M can unlock real cost advantages.

This combination of market maturity, contract pressure, and shifting risk profiles is transforming the landscape of onshore wind maintenance and pushing operators to rethink their strategies.

Maintenance Agreement Options

Maintenance parties within the onshore wind market now offer a range of maintenance options, either through the OEM or an independent service provider (ISP). The main agreement types are:

- Full Scope: The OEM or ISP covers nearly all defects and failures, while guaranteeing asset availability.

- Partial Scope: The OEM or ISP handles minor repairs and pre-defined major repairs. In practice, this can range from covering all major repairs except blades, to excluding major repairs entirely. Asset availability is typically guaranteed under the contract.

- Basic Maintenance: The OEM or ISP performs routine scheduled maintenance, but faults and remedial repairs are charged on a time-and-material basis. Availability guarantees are not always included.

- Self-Maintenance: The operator takes maintenance fully in-house, managing all activities with internal resources.

Many operators are forced reactively to decide what maintenance agreement is right for their assets when the market dictates. This can lead to rushed and poorly executed decisions being made.

The Challenges and Opportunities

For most operators, the question is not if but when they will need to move beyond full-scope service agreements. Developing proactive strategies to identify and manage the key challenges and opportunities is essential. Here are some of the most common issues faced when moving away from full-scope contracts:

- The reality of being responsible: Full-scope contracts can often be managed with little oversight. But once an operator assumes responsibility, the pressure of getting turbines back online quickly becomes real. This usually means ensuring the right spare parts and resources are available at the right time.

- Supply chain management: Operators will rely on many companies to supply parts and services to enable them to manage their new responsibilities, and this can invariably lead to problems in the new reality.

That being said, there are benefits to reduced scope contracts:

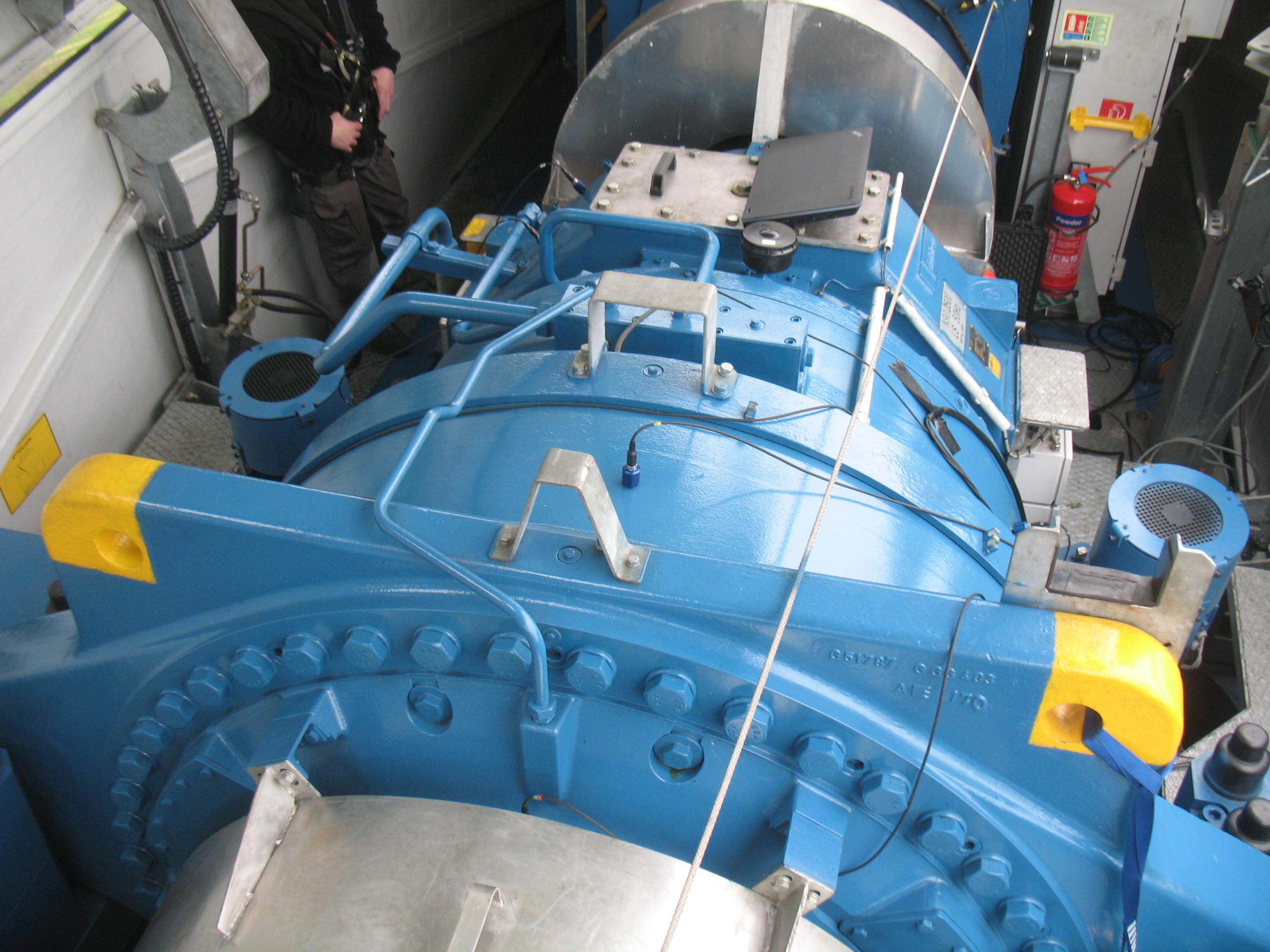

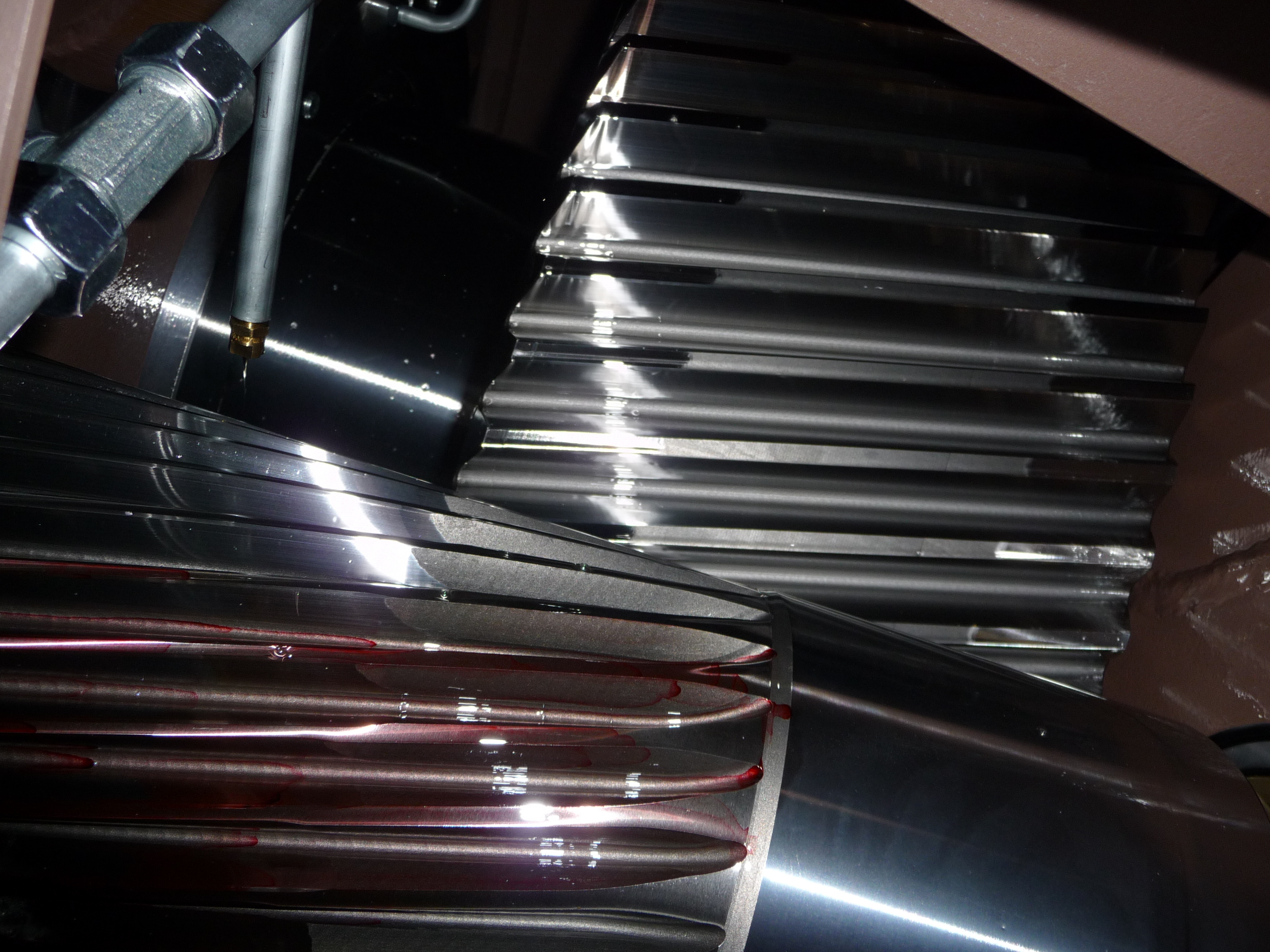

- Unlocking cost savings: Major component replacements are often seen as prohibitively expensive, often running into six figures. This is largely due to the high price of new components. However, refurbishment can often be achieved at a fraction of the cost, delivering significant savings when managed effectively.

- Leveraging modern condition monitoring: Affordable MEMS accelerometers and retrofit condition monitoring systems are now viable for most turbines. By monitoring component health, operators can plan major works in advance, turning unexpected failures into scheduled interventions.

- Making modifications to improve performance: Some OEMs/ISPs limit the ability of owners to make changes during full scope contract terms, and therefore moving away from full scope and taking on risk gives opportunity to make significant changes to the assets to improve performance.

How We Can Help

At Atharra, we help operators transform wind turbine maintenance; improving performance, reducing risk, and delivering measurable value through strategic, flexible support. We have a solution to almost any problem, but some of the areas we can help are presented below:

- Portfolio Strategy: Develop a portfolio-specific O&M strategy aligned with your company’s long-term ambitions.

- Tender Management: Manage the full O&M tender process, from tender documentation, bid submission and evaluation, contract negotiation to contract award.

- End-of-Contract Inspections: Deliver comprehensive inspection programs to identify defects and ensure accountability from outgoing service providers.

- Operational Readiness & Transition Planning: Support your team with items such as major component spares procurement, refurbishment routes, third-party contract negotiations, and SCADA/OT transitions to independent service providers.

- Engineering Support for Partial Scope O&M Contracts: Assist with ongoing engineering oversight of major components, ensuring defects are identified and resolved quickly and cost-effectively.

We'd be delighted to discuss this topic further, so please don't hesitate in getting in touch info@atharra.com